High-risk businesses often face limited options and higher fees when it comes to payment processing. Whether you operate in industries like CBD, adult services, supplements, or online gaming, finding a reliable and secure payment processor can be a major challenge. That’s where OpulencePay steps in as a leading high-risk payment processor in 2025, helping businesses not only get approved but thrive.

Understanding High-Risk Payment Processing

A business is considered “high-risk” by processors due to factors like high chargeback rates, regulatory restrictions, or operating in volatile industries. Traditional banks often avoid these businesses due to perceived risk, leaving merchants scrambling for alternatives.

Key challenges include:

Lower approval rates for merchant accounts

Higher processing fees

Increased likelihood of chargebacks and fraud

Limited access to traditional banking partners

Despite these hurdles, high-risk businesses need a partner that understands their needs—and OpulencePay delivers.

Why OpulencePay is the Best High-Risk Payment Processor

At OpulencePay, we’ve built a system that is designed specifically for high-risk industries. Here's why we're considered the best in 2025:

1. High Approval Rates

Unlike many traditional providers, we specialize in helping high-risk merchants get approved quickly. Our relationships with multiple backend processors allow us to match your business with the most appropriate gateway—often within 24 to 72 hours.

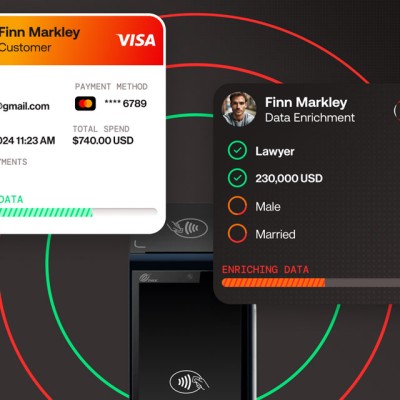

2. Fraud & Chargeback Protection

We offer best-in-class fraud detection tools, real-time transaction monitoring, and chargeback management services. This dramatically reduces risk and protects your revenue.

3. Transparent Pricing

No hidden fees. No surprises. OpulencePay provides clear, fair pricing for high-risk merchants with options like flat-rate, interchange-plus, or tiered models.

4. Multiple Industry Support

From nutraceuticals and CBD to adult entertainment and gaming, our systems are built to support virtually every high-risk vertical with confidence and compliance.

5. Flexible Integration Options

Whether you need a seamless website checkout experience, a mobile payment system, or recurring billing support, OpulencePay offers integrations with leading CRMs, shopping carts, and eCommerce platforms.

What to Look for in a High-Risk Payment Processor

When comparing high-risk processors, consider these key factors:

Do they offer fast approvals and reasonable documentation requirements?

Are their fraud protection tools automated and customizable?

Can they support international and multi-currency processing?

Do they provide clear reporting tools for chargebacks and analytics?

Is their support team knowledgeable about your industry?

OpulencePay checks all these boxes and more.

Success Story: Real Clients, Real Results

One of our clients in the subscription wellness industry experienced a 20% increase in successful recurring payments after switching to OpulencePay’s high-risk processing platform. The built-in fraud filters and seamless API integration helped them reduce chargebacks by over 40% in the first quarter.

The OpulencePay Advantage

- 24/7 Support: Speak with real experts who understand your industry.

- Global Acceptance: Accept payments from over 150 countries.

- Built-In Tools: Real-time analytics, fraud filters, and chargeback dashboards.

Conclusion

For high-risk businesses, partnering with the right payment processor is essential. OpulencePay provides everything you need to process transactions securely, stay compliant, and grow your business with confidence. With powerful tools, flexible integrations, and industry-leading support, we make high-risk payment processing easy, secure, and profitable.