In today’s ever-evolving payment ecosystem, finding a reliable and secure credit card processor can be especially difficult for businesses deemed “high-risk.” Whether you operate in industries like CBD, travel, supplements, adult entertainment, or recurring billing, high-risk businesses often face stricter scrutiny, higher fees, and limited access to traditional payment processors.

But that’s where OpulencePay steps in. As one of the top high-risk credit card processors in 2025, OpulencePay provides tailored payment solutions for high-risk merchants, ensuring that you can accept payments securely, scale with confidence, and stay compliant with regulations.

Why Some Businesses Are Considered High-Risk

Before diving into why OpulencePay is a trusted solution, it’s important to understand what makes a business “high-risk.” These businesses typically face:

High chargeback rates

Legal or regulatory scrutiny

Recurring billing models

International transactions

Higher potential for fraud

Examples include online dating, adult services, CBD products, subscription services, ticket brokers, and multi-level marketing.

What to Look for in a High-Risk Credit Card Processor

Choosing the right high-risk processor involves more than just finding someone willing to take on your business. Look for a provider that offers:

- Flexible underwriting: Not all processors understand the nuances of high-risk industries. You need a provider that does.

- Chargeback mitigation tools: With higher chargeback exposure, you need proactive prevention and resolution tools.

- Robust security: PCI-compliant processing, tokenization, and fraud detection are non-negotiable.

- Multi-currency support: Especially critical if you deal with international clientele.

- Scalable infrastructure: Your processor should grow with your business, not restrict it.

How OpulencePay Leads in High-Risk Processing

OpulencePay stands out as a top-tier choice among high-risk credit card processors because it delivers:

1. Fast & Flexible Approvals

Unlike traditional processors, OpulencePay offers streamlined approval processes designed with high-risk merchants in mind. Even businesses with limited processing history or complex business models can get approved and start accepting payments quickly.

2. Industry-Specific Expertise

Each high-risk business category has its own set of challenges. OpulencePay’s specialists provide strategic guidance and custom setups tailored for your industry — from CBD to adult entertainment and beyond.

3. Transparent Pricing

OpulencePay offers competitive, honest pricing — no hidden fees or unexpected rate hikes. You’ll receive a cost structure that aligns with your risk level and business size, allowing you to forecast and manage expenses better.

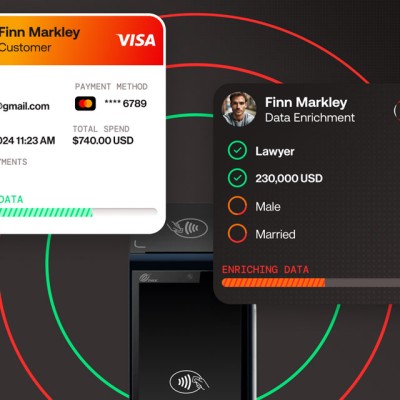

4. Advanced Fraud and Chargeback Protection

High-risk businesses are more likely to experience fraud and chargebacks. OpulencePay’s system includes real-time fraud filters, 3D Secure options, and automated chargeback alerts to mitigate these issues before they cost you.

5. Multi-Currency and Global Support

OpulencePay enables international processing with multi-currency support, so you can grow your business across borders without needing separate providers.

6. Seamless Integration

Our payment gateways, APIs, and virtual terminals work with the tools you already use — whether it’s an eCommerce platform or a custom billing solution.

Who Can Benefit from OpulencePay?

OpulencePay is the ideal payment processing partner for businesses in industries such as:

CBD and hemp products

Online dating and adult content

Travel agencies and booking services

Nutraceuticals and supplements

Subscription and membership businesses

Online coaching, webinars, or digital content

Whether you’re just starting out or looking for a more dependable processor, OpulencePay offers flexible, secure, and scalable solutions tailored to high-risk merchants.

Closing Thoughts

If you’ve been turned away by traditional credit card processors or are looking for a partner that truly understands your business model, OpulencePay is here to help. With transparent pricing, rapid approvals, and industry-leading fraud prevention, we empower high-risk merchants to grow confidently.